News & Resources

Year-End Market Review & Looking Ahead

2025 Market Review

As we close the books on 2025, it’s worth reflecting on what proved to be another remarkable year for investors — one that combined strong long-term results with meaningful short-term challenges.

Market Wisdom: The Forecasting Paradox

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about

the future.” – Warren Buffett

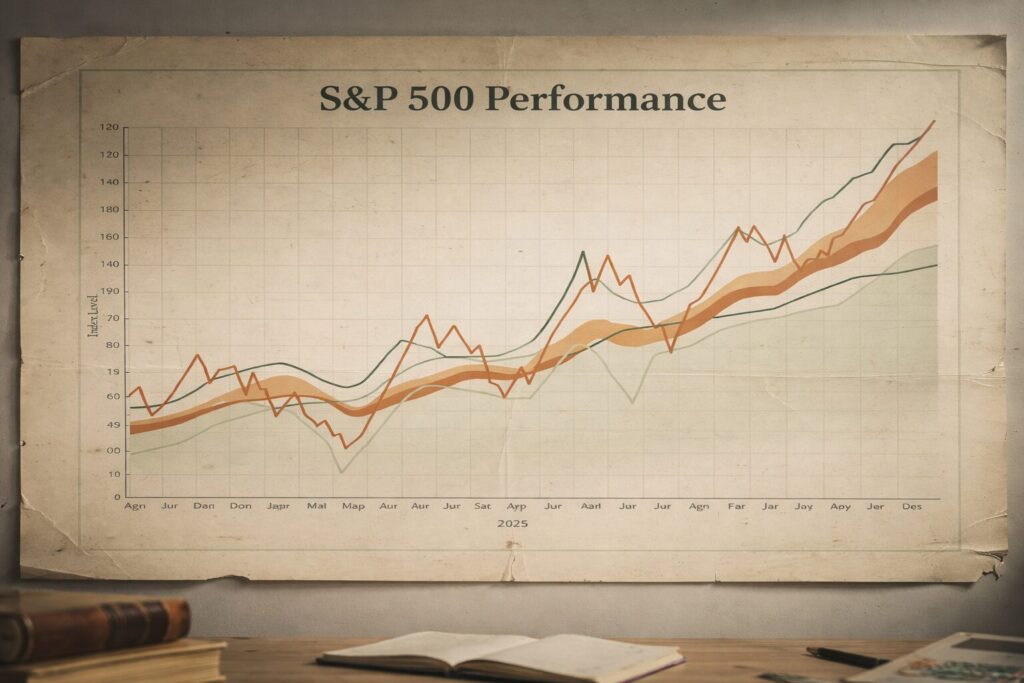

Despite gloomy 2025 predictions from Wall Street and TV pundits, the U.S. stock market

delivered an impressive outcome. The S&P 500® Index rose nearly 18% during the year

and reached 46 new all-time highs along the way.

The Turbulent Journey of 2025

The While the annual numbers are encouraging, they tell only part of the story. The experience of investing in 2025 was far from smooth, and understanding that journey is just as important as celebrating the destination.

This sequence serves as an important reminder: strong annual results often require patience, discipline, and the ability to endure uncomfortable periods along the way.

S&P 500 Index by the Numbers in 2025

Investors who stayed the course through those trying times were likely rewarded.

Markets ultimately moved forward despite uncertainty.

18%

Annual Return

S&P 500 Index total gain for 2025

46

All-Time Highs

New record peaks reached during the year

39%

Recovery Rally

Index rise from April 9 through year-end

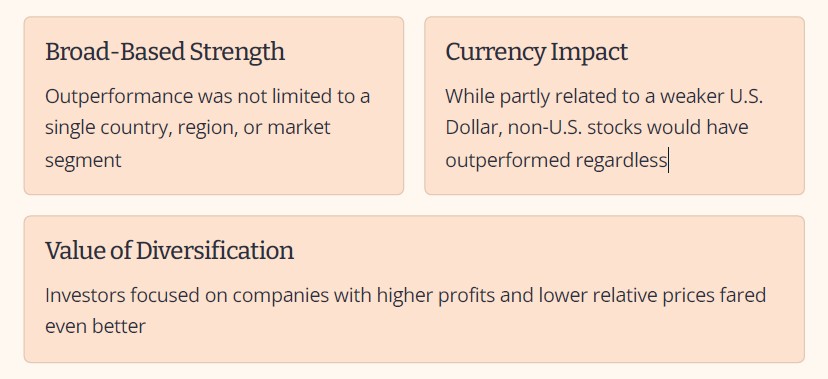

International Markets Stole the Show

For the first time since 2022, non-U.S. stocks outperformed their U.S. counterparts. The MSCI ACWI ex USA Index, representing both developed and emerging markets outside the U.S., outpaced the S&P 500 by approximately 14.5%—the largest margin of non-U.S. outperformance in the past 15 years.

Fixed Income: Bonds Deliver Solid Returns

In 2025, the U.S. bond market produced solid, broad-based returns, marking a welcome improvement after several challenging years for fixed income investors. The Bloomberg US Aggregate Bond Index had an impressive return of over 7%, as inflation pressures continued to ease and the Federal Reserve began cutting interest rates.

Bond prices benefited and income became more attractive across most sectors. U.S. Treasuries and investment-grade corporates performed well, supported by stable economic growth and healthy corporate balance sheets.

Fixed Income’s Traditional Role Reinforced

Municipal bonds similarly finished the year higher, helped by strong investor demand and limited new issuance. Interest-rate volatility was present at times, but the overall trend favored bond investors.

LOOKING AHEAD

2026

By many measures, 2025 was a good year for investors. It’s reasonable to feel pleased with the results while also acknowledging that market uncertainty does not simply disappear when the calendar turns.

The Foundation for Success

Investing for the future is a journey, not a single moment in time. It’s a story that unfolds over years and decades. Keeping that perspective front and center is a sound foundation as we begin the new year.

Moving Forward Together

At Verus, we will continue to monitor the markets while rebalancing accounts to maintain your target allocations. We look forward to guiding you through the

opportunities and challenges that lie ahead.

As always, thank you for your trust in Verus.

Important disclosure information

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Verus Financial Partners [“Verus”]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Verus. No amount of prior experience or success should not be construed that a certain level of results or satisfaction if Verus is engaged, or continues to be engaged, to provide investment advisory services.

Verus is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Verus’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.verusfinancialpartners.com.

Please Remember: If you are a Verus client, please contact Verus, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently.

Please Also Remember to advise us if you have not been receiving account statements (at

least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Verus account holdings correspond directly to any comparative indices or categories.

Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Verus accounts; and, (3) a description of each comparative benchmark/index is available upon request.

Latest Posts

-

2025 Tax Engagement Letter

Important Information for 2025 Verus Tax Clients. 2025 Tax Engagement Letter

-

How does Verus Financial Partners rank amongst national financial advisors?

CNBC analyzed 40,563 registered investment firms nationwide during their 7th year of publishing t…

-

2025 Q3 Investment Report

Third Quarter Financial Market Review Global markets continued their upward momentum through the …