News & Resources

2025 Q3 Investment Report

Third Quarter Financial Market Review

Global markets continued their upward momentum through the end of the third quarter. In fact, the S&P 500 closed in September at a new all-time high. Trade tensions eased as the U.S. reached new agreements. Meanwhile, the Federal Reserve shifted toward a more accommodative stance with a 0.25% rate cut in September.

The Stock Market: Strong Q3 Performance

27%

International Stocks

Year-to-date returns through Q3

15%

U.S. Stocks

Year-to-date returns through Q3

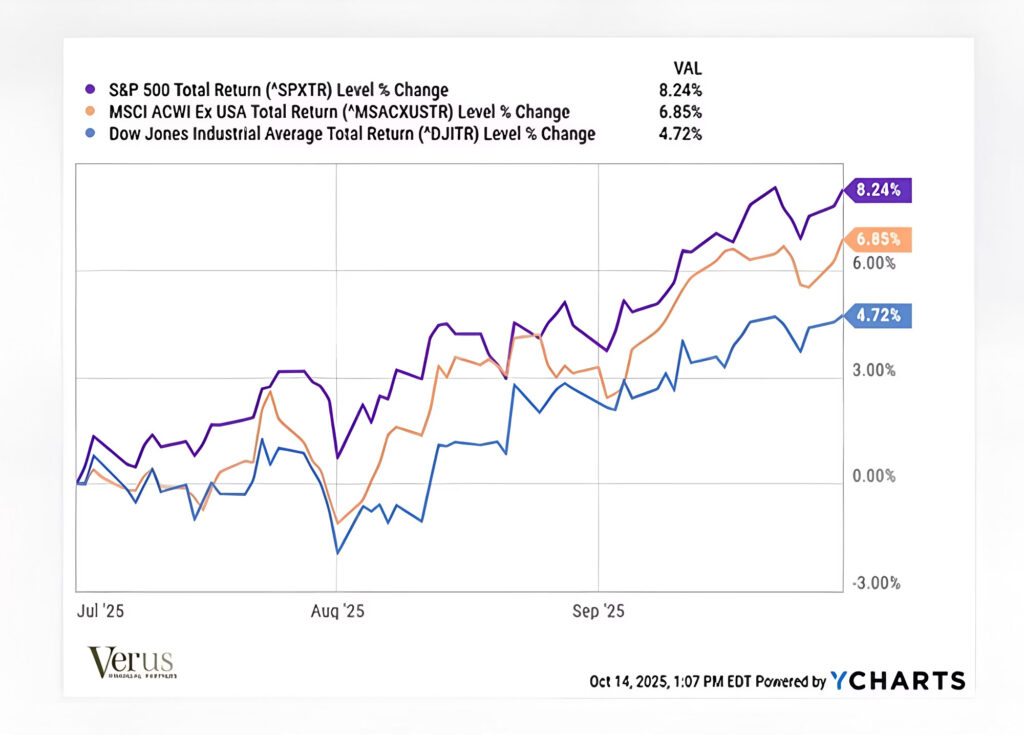

After a choppy first half, U.S. stocks gained solidly in Q3. The S&P 500, Dow Jones, and Nasdaq Composite all posted quarterly gains, with several indexes reaching new highs. Technology and AI-related companies continued to lead the charge, driven by innovation, productivity gains, and investor enthusiasm.

Market breadth improved significantly with small and mid-cap stocks joining the rally. This includes more value-oriented stocks, which signaled healthier market participation. International equities gained as the U.S. dollar softened and investors rediscovered opportunities abroad.

Stock Returns for the 3rd Quarter

The quarter ended on a strong note. This was despite the persistent volatility through September as investors digested mixed data and the Fed’s shifted expectations. Technology sectors led gains while broader market participation indicated healthy underlying strength across asset classes.

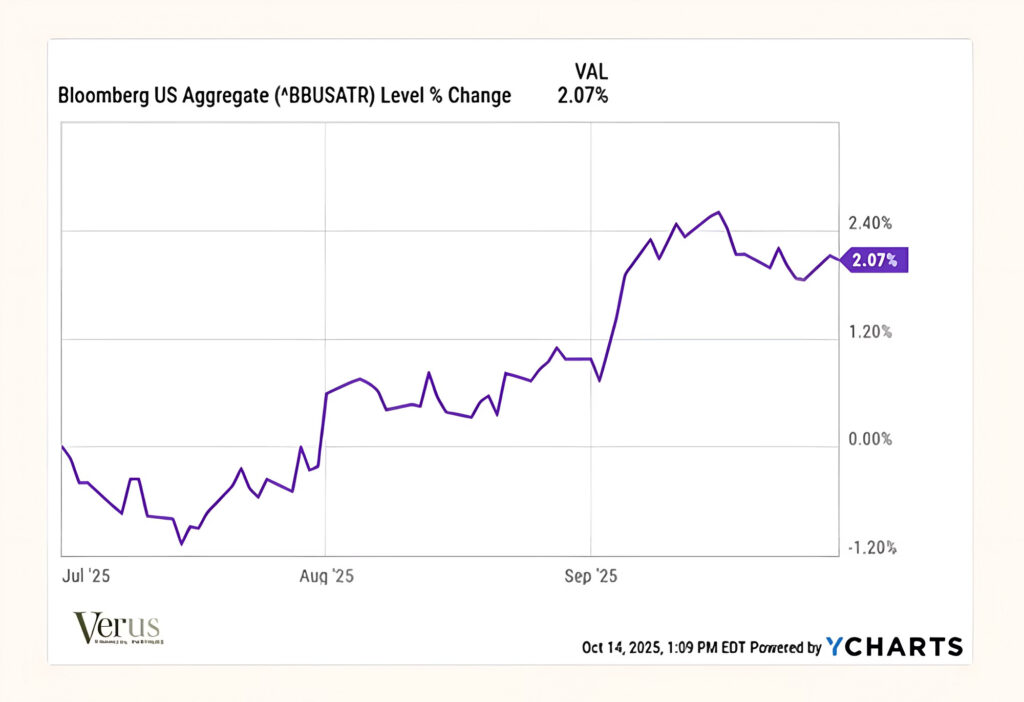

The Bond Market: Positive Returns

Bonds Remain Attractive

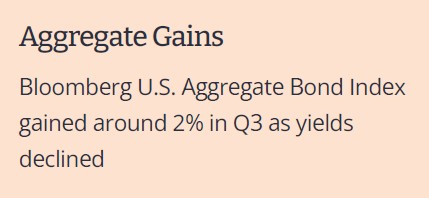

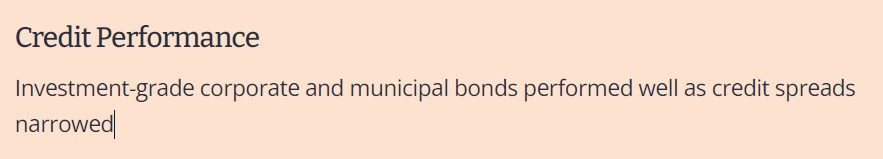

Global fixed income markets were mixed. Developed market bonds benefited from easing policy; meanwhile, emerging-market debt was pressured by currency volatility. The shift in Fed policy created a favorable environment for fixed-income investors. Despite interest rates falling, bonds are still attractive based on their current yields of about 4.4%. This provides investors with income and the potential for appreciation

should rates fall further. With higher starting yields and the Fed looking to ease rates, bonds are a good diversifier to pair with more volatile stocks.

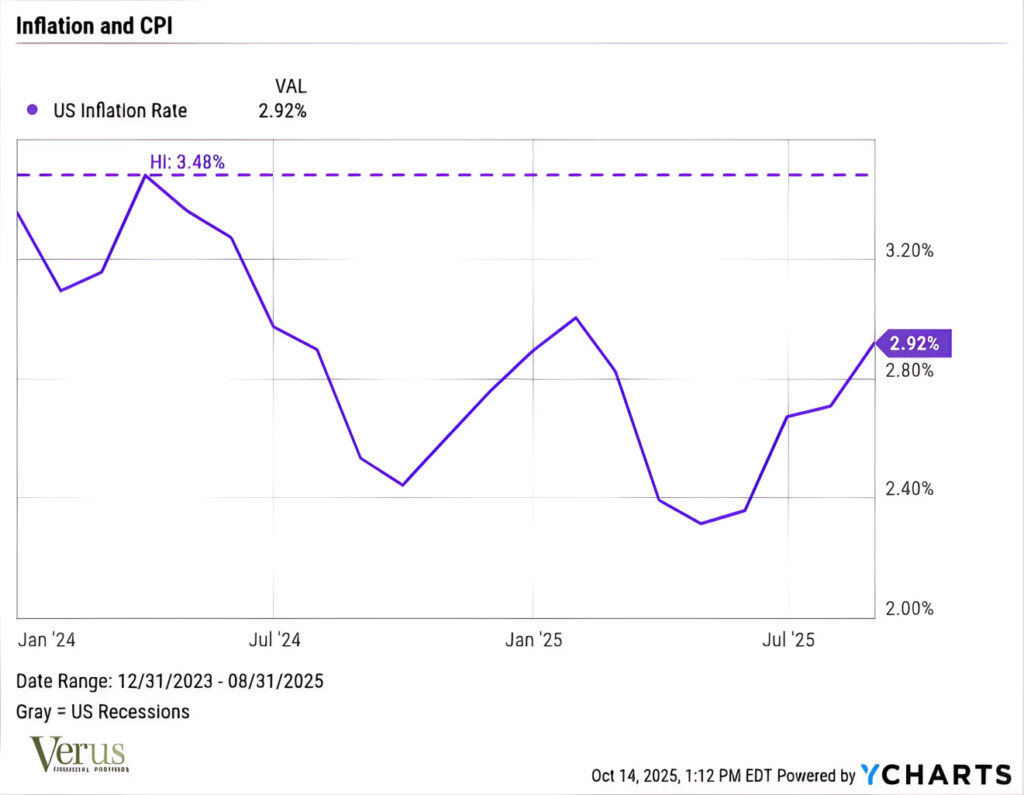

Inflation Trends: Sustained Moderation, but Watchful Eye on Future

U.S. inflation has shown a consistent trend of moderation in recent months. Subsequently, offering significant relief to consumers and guiding Federal Reserve policy. In comparison to the previous year, prices for goods and services are now rising at a slower pace. This reflects both the cooling demand and the ease of supply-side cost pressures.

As the chart clearly illustrates, inflation has been moving steadily downward over the past two years. This positive trajectory is expected to continue but will be closely monitored through the end of 2025. This sustained downward momentum strongly supports the Federal Reserve’s path toward gradual interest rate cuts, provided the trend persists and economic data align.

Our Strategy: Discipline and Diversification

We continue to believe that a balanced, diversified approach that utilizes international stocks, U.S stocks, and quality bonds will best position investors for the future. Discipline in sticking with your plan will be important.

At Verus, we will help guide you by reviewing allocations, rebalancing portfolios, and ensuring your strategy remains aligned with your long-term goals.

Stay Diversified

Remain Goal-Aligned

Trust the Process

Maintain balanced exposure across asset classes

Focus on long-term objectives, not short-term volatility

Timing trades can be costly – consistency wins

As always, the Verus team is by your side, guiding you through every market turn.

Important disclosure information

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Verus Financial Partners [“Verus”]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Verus. No amount of prior experience or success should not be construed that a certain level of results or satisfaction if Verus is engaged, or continues to be engaged, to provide investment advisory services.

Verus is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Verus’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.verusfinancialpartners.com.

Please Remember: If you are a Verus client, please contact Verus, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently.

Please Also Remember to advise us if you have not been receiving account statements (at

least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Verus account holdings correspond directly to any comparative indices or categories.

Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Verus accounts; and (3) a description of each comparative benchmark/index is available upon request.

Latest Posts

-

2025 Tax Engagement Letter

Important Information for 2025 Verus Tax Clients. 2025 Tax Engagement Letter

-

2025 Year-End Review

2025 Market Review As we close the books on 2025, it’s worth reflecting on what proved to b…

-

How does Verus Financial Partners rank amongst national financial advisors?

CNBC analyzed 40,563 registered investment firms nationwide during their 7th year of publishing t…